personal loans for bad credit greenville nc

Add a review FollowOverview

-

Founded Date September 21, 1976

-

Posted Jobs 0

-

Viewed 7

Company Description

Best Bad Credit Score Personal Loans: A Complete Guide

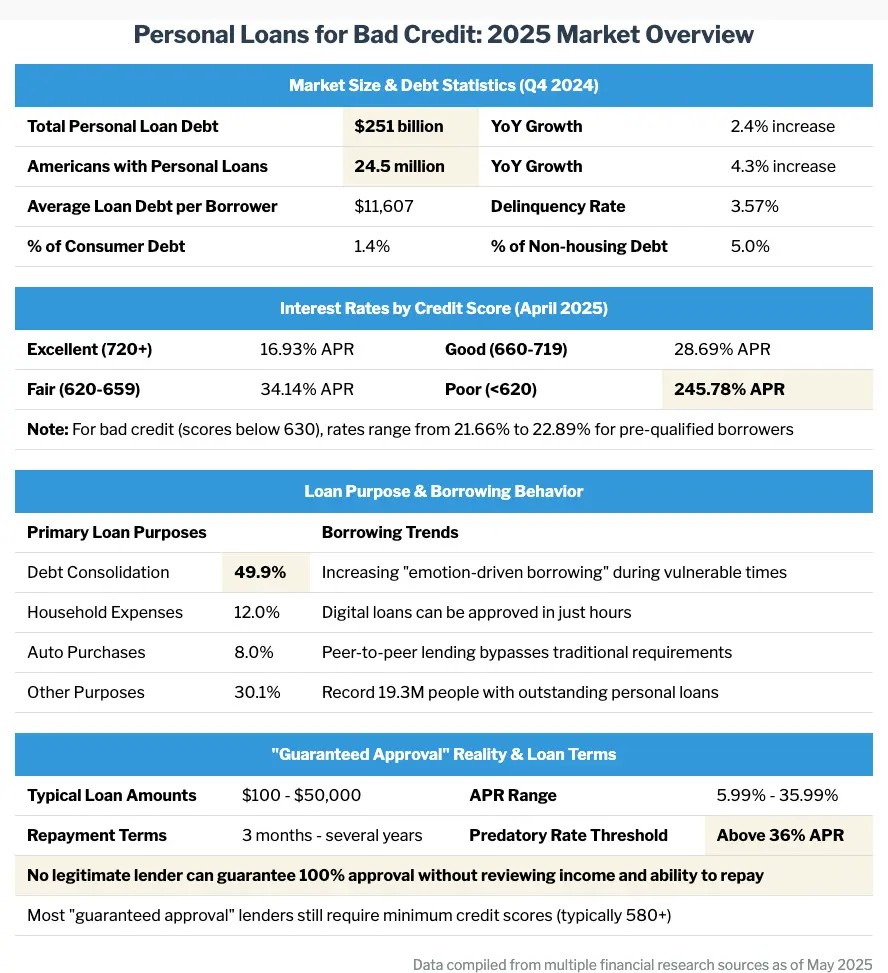

In at present’s financial landscape, having bad credit could make borrowing money extra challenging. Nonetheless, personal loans for individuals with poor credit are nonetheless accessible. These loans is usually a lifeline for many who need urgent funds for emergencies, debt consolidation, or other financial wants. This report will explore the most effective bad credit score personal loans, their options, and tips for securing one.

Understanding Bad Credit Personal Loans

Dangerous credit personal loans are designed for borrowers with a low credit rating, usually beneath 580. These loans usually come with larger interest rates and fewer favorable terms than loans for borrowers with good credit score. Nonetheless, they’ll nonetheless present important financial support.

Key Features of Bad Credit score Personal Loans

- Larger Interest Charges: Lenders typically charge greater interest rates to mitigate the danger associated with lending to borrowers with poor credit.

- Versatile Amounts: Many lenders offer a spread of loan amounts, from a couple of hundred to a number of thousand dollars.

- Shorter Repayment Phrases: Bad credit score personal loans usually have shorter repayment periods, normally starting from one to 5 years.

- Secured vs. Unsecured: Some lenders might require collateral for a secured loan, whereas unsecured loans don’t require any collateral but may include stricter requirements.

Prime Lenders for Dangerous Credit Personal Loans

1. Avant

Avant is a well-liked alternative for borrowers with dangerous credit. They offer loans ranging from $2,000 to $35,000 with repayment phrases of 24 to 60 months. The application process is easy, and funds will be accessible as soon as the subsequent enterprise day. Avant is known for its clear payment construction and customer service.

2. Upstart

Upstart is unique in that it uses artificial intelligence to assess creditworthiness, considering elements beyond simply credit score scores. If you have any thoughts regarding exactly where and how to use Personalloans-badcredit.Com, you can contact us at our own internet site. Borrowers can take out loans from $1,000 to $50,000 with repayment phrases of three to 5 years. Upstart is particularly appropriate for younger borrowers or those with limited credit historical past.

3. OneMain Monetary

OneMain Monetary focuses on personal loans for those with bad credit. They provide secured and unsecured loans ranging from $1,500 to $20,000. The applying course of is straightforward, and borrowers can receive funds shortly. OneMain also provides a personalized strategy, working intently with borrowers to seek out suitable repayment options.

4. LendingClub

LendingClub is a peer-to-peer lending platform that connects borrowers with buyers. They provide personal loans ranging from $1,000 to $40,000, with phrases of three or five years. Whereas LendingClub does consider credit scores, in addition they look at other factors, making it a viable choice for these with dangerous credit score.

5. BadCreditLoans.com

Because the name suggests, BadCreditLoans.com specializes in connecting borrowers with lenders willing to work with individuals with poor credit. They offer a wide range of loan quantities and have a simple on-line utility course of. This platform is ideal for borrowers looking to discover multiple choices.

Ideas for Securing a nasty Credit score Personal Loan

- Check Your Credit score Report: Earlier than applying for a loan, evaluation your credit report for errors. Correcting inaccuracies can enhance your credit rating.

- Store Round: Examine gives from multiple lenders to seek out one of the best interest rates and phrases. Use online comparison tools to make the process easier.

- Consider a Co-Signer: If potential, discover a co-signer with good credit score to increase your possibilities of approval and safe higher terms.

- Be Lifelike About Loan Quantities: Borrow only what you want and can afford to repay. This can make it easier to keep away from falling into a debt trap.

- Perceive the Phrases: Read the tremendous print carefully to know the curiosity rates, fees, and repayment phrases. Look for any hidden charges that could affect the total cost of the loan.

Conclusion

Unhealthy credit personal loans can present important monetary assist for people going through unexpected expenses or needing to consolidate debt. While these loans typically include higher interest rates and less favorable terms, a number of reputable lenders cater specifically to borrowers with poor credit score. By researching your options, comparing presents, and understanding the terms, you’ll find a bad credit personal loan that meets your needs and helps you regain financial stability. All the time remember to borrow responsibly and guarantee that you could meet the repayment obligations to avoid further damaging your credit score.