personal loans for bad credit and no cosigner

Add a review FollowOverview

-

Founded Date April 16, 2001

-

Posted Jobs 0

-

Viewed 29

Company Description

Understanding Personal Loans For Bad Credit: A Complete Information

When faced with monetary difficulties, many people seek personal loans to assist cowl unexpected expenses, consolidate debt, or fund important purchases. However, for these with dangerous credit, securing a personal loan generally is a daunting process. This article goals to provide a comprehensive overview of personal loans for bad credit, exploring the choices available, the applying process, and suggestions for improving your possibilities of approval.

What’s a Personal Loan?

A personal loan is an unsecured loan that enables borrowers to entry a lump sum of cash, which they’ll repay over a hard and fast time period with curiosity. Unlike secured loans, personal loans don’t require collateral, making them a preferred choice for people looking to finance private expenses. The loan quantity, interest fee, and repayment phrases can fluctuate significantly based on the lender and the borrower’s credit profile.

Understanding Unhealthy Credit score

Unhealthy credit usually refers to a low credit score score, which can outcome from varied components, including missed funds, excessive credit utilization, defaults, or bankruptcy. Credit score scores generally range from 300 to 850, with scores below 580 thought-about poor. Lenders use credit scores to evaluate the chance of lending money, and people with unhealthy credit typically face greater curiosity charges or could also be denied loans altogether.

Why Bad Credit Impacts Loan Approval

Lenders view bad credit as an indicator of a borrower’s chance to repay the loan. A historical past of late funds or defaults raises issues about financial duty and will increase the perceived threat for lenders. Consequently, borrowers with bad credit might encounter challenges when making use of for personal loans, including restricted options and unfavorable phrases.

Options for Personal Loans with Bad Credit score

Whereas securing a personal loan with dangerous credit score can be challenging, a number of choices can be found:

- Credit Unions: Credit unions are member-owned financial institutions that often supply more favorable phrases than traditional banks. They may be extra prepared to work with individuals with bad credit and may provide decrease interest charges and charges.

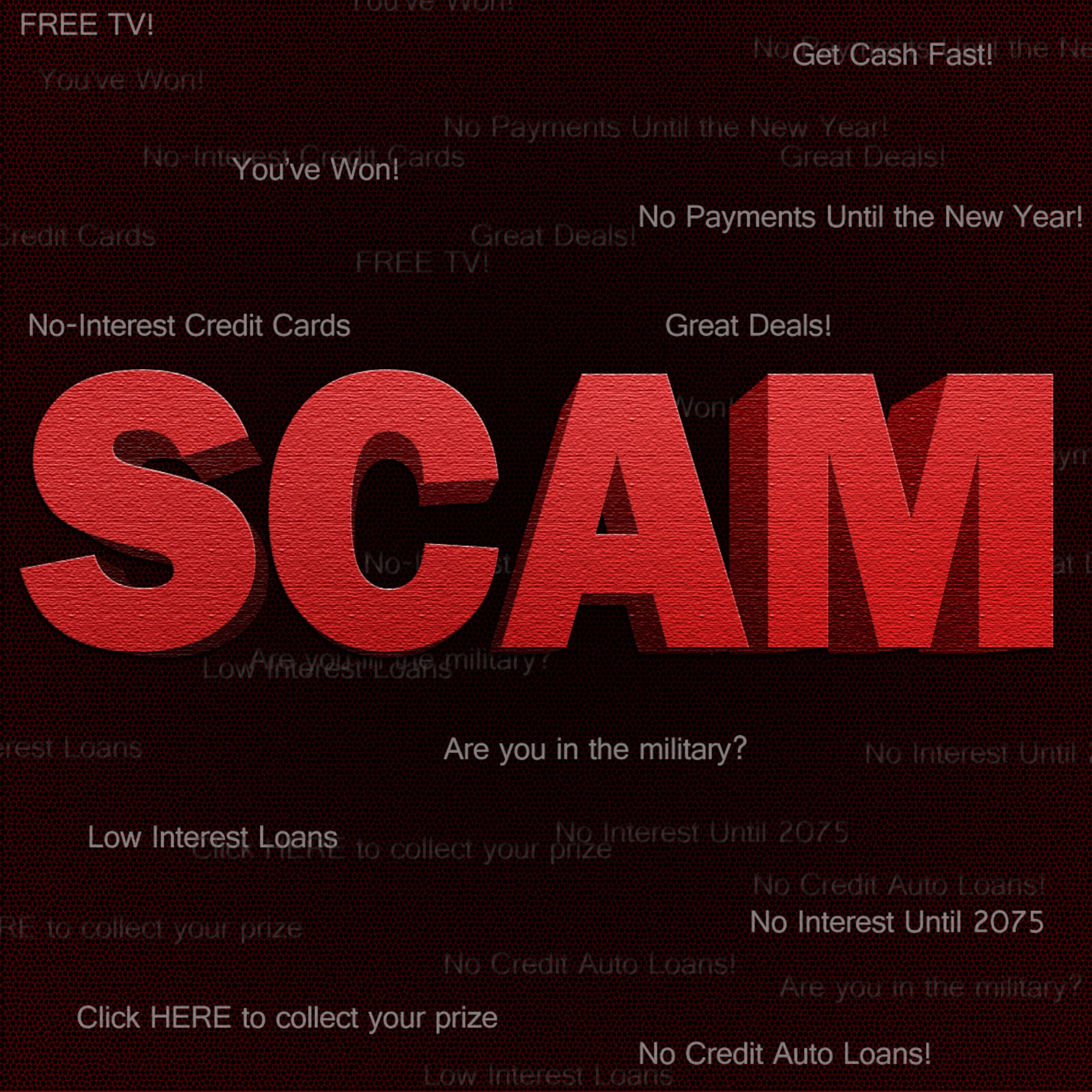

- Online Lenders: Numerous online lenders focus on personal loans for individuals with unhealthy credit score. These lenders typically have more lenient eligibility criteria and can provide quick access to funds. Should you have any kind of questions regarding wherever as well as tips on how to work with unsecured personal loans bad credit, you can contact us from our web-site. However, borrowers should be cautious and analysis lenders thoroughly to avoid predatory practices.

- Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers with particular person buyers prepared to fund loans. These platforms might consider components past credit score scores, akin to revenue and employment historical past, making them a viable choice for those with unhealthy credit.

- Secured Loans: Secured loans require collateral, resembling a vehicle or savings account, which can cut back the lender’s threat. Borrowers with unhealthy credit might discover it simpler to acquire a secured loan, but they must be cautious, as failure to repay could result within the lack of the collateral.

- Co-Signer Loans: Having a co-signer with good credit can enhance the possibilities of loan approval and should lead to higher phrases. A co-signer agrees to take responsibility for the loan if the first borrower defaults, offering lenders with added safety.

The applying Process

Making use of for a personal loan with dangerous credit involves several steps:

- Examine Your Credit Report: Earlier than applying, evaluation your credit score report for errors and discrepancies. You’ll be able to get hold of a free credit report from each of the three main credit score bureaus once a yr. Correcting any inaccuracies can improve your credit rating.

- Research Lenders: Compare totally different lenders, specializing in their terms, curiosity rates, and charges. Look for lenders that particularly cater to individuals with unhealthy credit.

- Collect Documentation: Put together the mandatory documentation, which may embody proof of earnings, employment verification, and identification. Having these paperwork prepared can streamline the appliance course of.

- Apply for the Loan: Submit your software to the chosen lender. Be trustworthy about your monetary state of affairs and supply accurate info to avoid potential issues down the line.

- Assessment Loan Terms: If authorised, carefully review the loan terms, together with the interest price, repayment schedule, and any fees. Ensure you understand the whole price of the loan before accepting it.

Tips for Bettering Your Chances of Approval

- Enhance Your Credit Rating: Taking steps to enhance your credit score can enhance your probabilities of loan approval. Pay down existing debts, make timely funds, and avoid taking on new debt before applying for a loan.

- Consider a Smaller Loan Amount: If doable, request a smaller loan quantity, as lenders could also be more willing to approve lower quantities for borrowers with unhealthy credit score.

- Provide an in depth Rationalization: In case your dangerous credit is due to particular circumstances, corresponding to medical bills or job loss, consider offering a written explanation to the lender. This transparency will help them perceive your scenario better.

- Show Stable Earnings: Demonstrating a stable earnings can reassure lenders of your skill to repay the loan. Embrace pay stubs, tax returns, or financial institution statements as proof of revenue.

- Keep away from Multiple Purposes: Submitting a number of loan applications inside a brief interval can negatively influence your credit rating. As a substitute, deal with one or two lenders that you consider are the perfect fit to your needs.

Conclusion

Securing a personal loan with bad credit may be challenging, however it isn’t unimaginable. By understanding your options, enhancing your credit score, and approaching lenders strategically, you’ll be able to increase your chances of obtaining the financial assistance you need. Remember to borrow responsibly, guaranteeing you could comfortably manage the repayments to keep away from further financial difficulties. Whether or not you select a credit score union, online lender, or a secured loan, being informed and ready will enable you navigate the lending panorama successfully.